Natural Disaster Coverage: What You Need to Know

Living in Japan means being prepared for various natural disasters. Understanding insurance policies that protect against earthquakes, typhoons, and other calamities is crucial for safeguarding your property and peace of mind.

Earthquake Insurance

Earthquake insurance is not typically included in standard homeowners' policies in Japan. It's a separate policy that covers damage from earthquakes, volcanic eruptions, and tsunamis. Key points to consider:

- Coverage is usually limited to 30-50% of your fire insurance amount

- Premiums vary based on location and building structure

- There's often a high deductible, so review the terms carefully

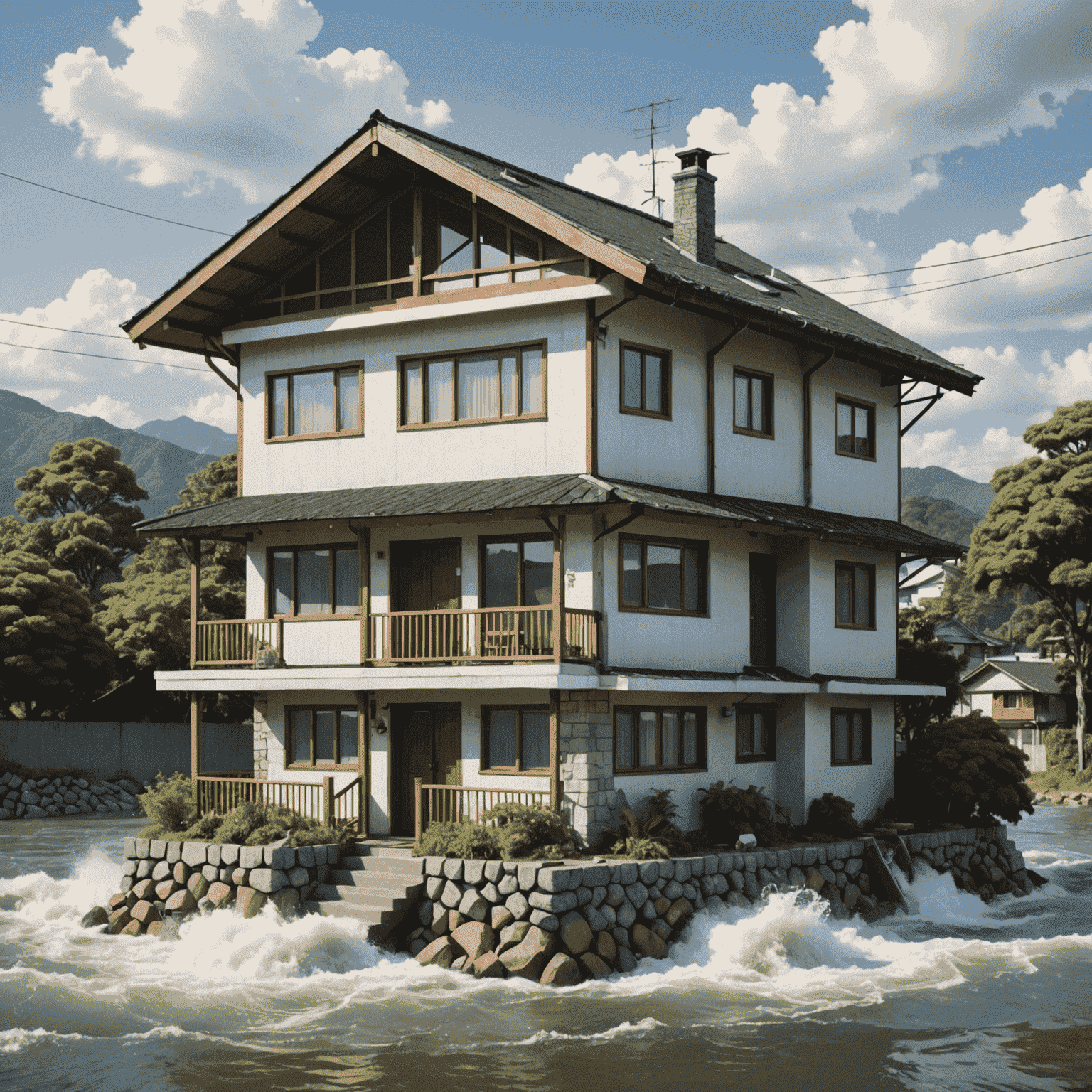

Typhoon and Flood Insurance

Unlike earthquake coverage, protection against typhoons and floods is typically included in standard fire insurance policies. However, it's essential to review your policy to understand:

- The extent of coverage for wind and water damage

- Any exclusions or limitations for severe weather events

- Additional coverage options for personal belongings

Landslide and Volcanic Eruption Coverage

Given Japan's diverse geography, it's important to consider coverage for landslides and volcanic eruptions. These events may be covered under specialized policies or as add-ons to existing insurance.

Tips for Choosing the Right Policy

- Assess your risk based on your location in Japan

- Review multiple policies and compare coverage options

- Understand the claim process and required documentation

- Consider bundling policies for potential discounts

- Regularly update your policy as your circumstances change

Expert Tip

Always keep digital copies of your insurance policies and important documents in a secure, easily accessible location. This can expedite the claims process in the event of a disaster.

Conclusion

Natural disaster insurance is an essential consideration for anyone living in Japan. By understanding your options and choosing the right coverage, you can protect your home and belongings against the unpredictable forces of nature. Remember to review your policies regularly and stay informed about changes in insurance regulations to ensure you're always adequately protected.